Child care is essential for Kentucky families to thrive. With annual costs reaching up to $11,000, however, families across Kentucky are struggling to pay for child care.

Child care is essential for Kentucky families to thrive. With annual costs reaching up to $11,000, however, families across Kentucky are struggling to pay for child care.

The Child Care Assistance Program (CCAP) helps eligible families pay for child care, providing vital support to families with young children. Despite how vital the program is, very few eligible families are participating in the program and applying for and participating in the program can be confusing.

With more families now eligible for CCAP, we wanted to create a resource to help families navigate CCAP, from the application to the recertification process. This FAQ is designed with families in mind, and we hope it helps you answer any questions you may have about the program. If you have additional questions, please submit those HERE.

This blog post will be updated periodically with new information and resources.

Qualifications

What is the Child Care Assistance Program?

- The Child Care Assistance Program helps low-income families who are actively searching for work or working pay for childcare.

What are the qualifications to receive CCAP benefits? Once approved, what are the qualifications to continue receiving CCAP benefits?

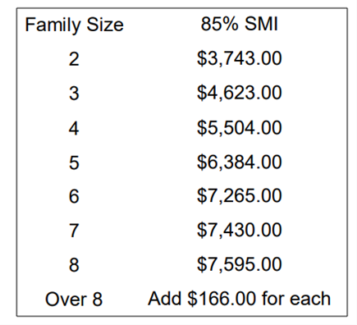

- To qualify for CCAP benefits, a family must reside in Kentucky, have a child younger than 13, live within 85% of the State Median Income (SMI), and be one of the following:

- Employed working an average of 20 hours a week as a single parent or working an average of 40 hours a week as a couple;

- A full-time student enrolled in a certified trade school, college or university;

- Enrolled in the K-TAP KentuckyWorks Program or the SNAP Employment and Training Program.

- Unemployed, but participating in the three month Job Search period

- DCC-90P Job Search Documentation

- Teen parents enrolled in high school or GED classes and families involved with the Division of Protection and Permanency (P&P) can participate in CCAP regardless of income.

- To continue participating in CCAP, families must have a child who is younger than 13, live within 85% of the State Median Income, and continue to meet the CCAP eligibility requirements:

I am not a U.S. Citizen. Can I still receive CCAP benefits for my child?

I am not a U.S. Citizen. Can I still receive CCAP benefits for my child?

- A child must be a U.S. Citizen or qualified immigrant to receive CCAP. However, adults in the home do not have to be U.S. citizens or qualified immigrants to receive CCAP for their children.

- A qualified immigrant is someone who has permanent resident status or has been granted asylum.

- Your child does not need a Social Security Number to apply for CCAP benefits.

Does a foster/kinship care placement qualify for CCAP?

- Children in foster care are not eligible for CCAP; however, child care assistance is available to children in foster care. Foster parents that need child care should talk with their case worker.

- Kinship families may qualify for CCAP if they meet eligibility requirements.

My family is homeless. Can I apply for CCAP?

- Families who are homeless, provide an ID, and report meeting the requirements for CCAP are eligible for immediate CCAP approval.

- ID’s can be a driver’s license, student ID, military ID, or two other forms of verification.

- Benefits will begin immediately, and homeless families will have three months from the date of application to provide the Kentucky Department of Community Based Services (DCBS) with all the necessary documentation for approval.

- Homeless families who do not provide documentation within three months from the date of application will be deemed ineligible, and their CCAP case will close.

Application

What documents and paperwork will CCAP applicants need to send to the Cabinet for Health and Family Services (CHFS) in order to have their application processed?

- ID for Heads of Household, such as:

- Driver’s License

- Student ID

- Military ID

- Two other forms of verification.

- Birth Verification:

- Birth Certificate for those receiving benefits

- Hospital birth record for those receiving benefits

- Proof of Residency and Household Composition, such as:

- PAFS-76 Information Request Form

- Current lease

- Written statement from someone who knows the family but does not live in the household.

- Tax records

- Earned Income Documentation, including but not limited to:

- W2

- Paystub

- Letter from your employer verifying your income

- Unearned Income Documentation, including but not limited to:

- Child support award letters

- Current award letters

- Social Security (requested, but not required)

- Proof of Educational Enrollment (if you are a full-time student), including but not limited to:

- School records or transcript

- Verification of enrollment

- “CC” with the school’s admission office

- Proof of Citizenship, Immigration Status Documentation, or Refugee Status for those Receiving Benefits

- NOTE: Parents do not need to provide proof of their citizenship or immigration status.

How long does it typically take for CCAP applications to be processed?

- CCAP applications will be processed within 30 days of being submitted.

- CHFS will notify families of their application status by letter of through the Kynect system.

- If you have not heard an update on your application status within 30 days of submission, please contact DCBS at (502)564-3440.

What is the job search period?

- The job search period is a three month period from the date of initial CCAP application during which families can receive CCAP if they are actively seeking employment.

- If a family is unable to find a job during this three month period, they will be deemed ineligible and their CCAP case will close.

- The job search period, at initial application, can only be used once in a 12 month period.

- Applicants begin the job search period by filling out the DCC-90P Job Search Documentation form.

If I apply but do not use the program right away, do I lose the job search period?

- Once the Job Search option is initiated, it is considered used. The start date for the Job Search period begins on the date of the initial application.

My spouse is currently incarcerated. Will they be counted as part of my household?

- Incarcerated individuals are not included in household determinations.

I receive other public benefits. Will this impact my ability to receive CCAP?

- No – benefits received from SNAP, SSI, K-TAP, and other benefits programs administered by the Cabinet for Health and Family Services do not impact your ability to receive CCAP benefits.

Why is it important to share a child’s disability status (special needs) on my CCAP application? What proof of this status do I need to provide?

- Children with special needs are eligible for CCAP until they are 19.

- To prove a child’s disability status, families can provide:

- A diagnosis from a qualified health professional, such as a child’s pediatrician or a mental health professional.

- A court order

- An Individual Education Program (IEP) provided by a child’s school

- An award letter for Supplemental Security Income (SSI) benefits

I share custody of my child with another parent, and we both need child care. Do we have to apply for CCAP separately?

- Parents who share custody of a child must file for CCAP assistance separately. When applying, you must indicate what days the child is with you.

Receiving Benefits

Can I use CCAP for any child care program? Can I use CCAP for multiple childcare programs?

- Providers must be Licensed, Certified or Registered with the Kentucky Division of Child Care (DCC). They must accept CCAP subsidy payments and be approved by the Division of Child Care.

- CCAP can be used at multiple childcare programs.

I received CCAP but am having trouble finding a childcare center. What resources are available?

- There are several resources families can use to identify childcare providers:

- Community Coordinated Child Care (4-C) can help families search and receive referrals for childcare at https://www.4cforkids.org/for-families/find-child-care/ or by calling (502)636-1358.

- Child Care Aware of America can help families locate childcare providers in their areas at https://www.childcareaware.org/resources/ccrr-search/.

- Kynect can also help families search for child care providers at https://kynect.ky.gov/benefits/s/child-care-program or by calling (855)306-8959.

How does an applicant estimate what their copay will be?

- Copays are currently waived for families as a result of federal COVID-19 pandemic relief funding. When this funding runs out, DCC will notify families and copayments will resume.

- Families can estimate their copay by looking at this chart

- If a family receives CCAP as a result of a Protection and Permanency Case, copays may be waived.

Does the child care assistance backdate to the application date or does it start after the benefit is processed and the contract is received?

- If approved, CCAP eligibility begins on the date of application.

- Providers will receive payment covering the period from the date of application to the date of approval.

Where can I learn about changes and updates in my CCAP case?

- Kynect will alert families about updates and changes to their case. Families should be checking Kynect on a regular basis to ensure they do not miss any updates.

- Occasionally, DCBS will mail families about updates to their case. Families should check their mail regularly and ensure their address on file is accurate.

Recertification + Change Reporting

What is recertification?

- The process by which CHFS determines if you are still eligible for the program based on any changes in your work status and income.

How often will I need to recertify my benefits?

- Families will have to recertify for CCAP on a yearly basis.

How do I recertify? What documentation will I need to recertify?

- Families can recertify for CCAP by calling DCBS or visiting a local DCBS office to set up an interview.

- Recertification will look very similar to the interview process you do when you initially get CCAP.

- To recertify, you will have to have the following documents:

- Proof of Identification:Driver’s License, State Issued Photo ID, Military ID

- Birth Verification:KVETS, Birth Certificate, Hospital Birth Records

- Earned Income:PAFS-700, Wage Stubs, Written Statements (from employer)

- Self-Employments:Tax Returns (with Schedule C), Business Records, Work Logs, Written Statements

- Unearned Income:Current Award Letters

- Household Composition & Residency:PAFS-76, Current Lease (must list everyone living in the home), Written Statements

- Zero Income:PAFS-702, Written Statement

What is change reporting?

- Change reporting is the process of alerting DCBS of any changes that may impact your CCAP benefits.

- All changes have to be reported to CHFS within 10 days of the change happening. If a family fails to alert the Cabinet of a change within 10 days, they can risk losing benefits or being charged with fraud.

What changes do I have to report to CHFS?

- Beginning or ending employment

- Change in an employer

- Increase or decrease in the number of work hours

- Increase or decrease in the rate of pay

- Increase or decrease in household members

- Change in self-employment activities

- Change in the scheduled hours care is needed

- Beginning or ending a full time educational or training activity;

- Change in child care providers

- Change in address or residence

- Change in marital status

- Beginning or ending participation in SNAP E&T or Kentucky Works activity

- Beginning or ending receipt of any type of unearned income.

How do I report changes to CHFS?

- You can report changes to CHFS by calling DCBS or visiting your local DCBS office.

Appeals

I was sent a Notice of Suspected Intentional Program Violation. Can I appeal?

- Yes – families who receive a Notice of Suspected Intentional Program Violation have a right to appeal.

- Families must appeal by requesting a hearing within 30 days.

The Notice of Suspected Intentional Program Violation included a Voluntary Waiver of Administrative Disqualification Hearing. Do I have to sign this?

- No – the Voluntary Waiver of Administrative Disqualification Hearing is a voluntary document and families are not required to sign.

- If a family does sign this document, they will not be able to appeal their case.

How does the appeals process work?

- If a family decides to appeal an Intentional Program Violation (IPV), they will request an Administrative Hearing with an Administrative Hearing Officer.

- This hearing will be held within 45 days of when a family requests a hearing.

- The family can withdraw their appeal at any time.

- Families can request an interpreter or reasonable accommodations for the hearing.

- At this hearing, both the agency (CHFS/DCBS) and the family can submit evidence to support their case.

- After the hearing, the Hearing Officer will submit a Recommended Order either affirming or denying the agencies decision to charge a family with an IPV. The order includes a report to the CHFS Secretary (Secretary Eric Friedlander), which includes a Findings of Fact & Conclusions of Law.

- If families are unhappy with the Hearing Officer’s determination, they have 15 days to appeal the decision with the CHFS Secretary. The Secretary will take all the information from the case and either affirm or deny the hearing officers determination, which is called the Final Order.

- If families are unhappy with the Secretary’s Final Order, they have up to 30 days to appeal the case with the Circuit Court.

- NOTE: You will not be given a lawyer; however, your local Legal Aid may be able to help with your case.

Will I have to pay back CHFS for any overpayments?

- Yes – families will have to pay back any overpayments, even if they win their appeals case or the overpayment was found to be someone else’s fault.

- Families can request to pay back via installments (see below).

What happens if I fail to pay back an overpayment?

- If a family fails to make an initial payment or is more than sixty days late on a payment, CHFS can attempt to collect the overpayment by:

- Ordering a repayment through the court;

- Taking all of or part of a families state tax refund;

- Garnishing a portion of a families wages;

- Lottery winnings; or

- Refering a family to a collection agency.

I was charged with an Intentional Program Violation (IPV). What does this mean for my CCAP benefits?

- For the first IPV charge, families will be disqualified from CCAP for 12 months.

- For the second IPV charge, families will be disqualified from CCAP for 24 months.

- For the third IPV charge, families will be disqualified from CCAP permanently, unless a judge determines a different disqualification period.

Can I apply for CCAP again after I have been charged with an Intentional Program Violation?

- Yes, you can apply for CCAP again once your disqualification period has ended.

This is honestly a good program . However I lost my job when it was time to sign back up and no one there knew what to do with my case. I called for two months. My employer plus my day care held my spot for 2 months ( that’s quiet a while) til I could sort this out. I even started calling before the date ended to sign up so the process wouldn’t be so long. I’ve not worked since Dec 2nd 2021.

Your perspective on this is unique and refreshing. Thanks for adding something new to the conversation!